The municipal pawnshop of Amsterdam, the Stadsbank van Lening, has been around since 1614. Nowadays, it’s an important facility for the city’s underprivileged citizens who temporarily need some cash to repair a broken washing machine, for instance. Almost ten percent of Amsterdam’s minimum-wage citizens uses the Stadsbank.

The Challenge

The municipal pawnshop of Amsterdam, the Stadsbank van Lening, has been around since 1614. Nowadays, it’s an important facility for the city’s underprivileged citizens who temporarily need some cash to repair a broken washing machine, for instance. Almost ten percent of Amsterdam’s minimum-wage citizens uses the Stadsbank. Anybody can come here to take out a loan against submitting collateral, such as a gold ring or diamond earrings. The Stadsbank employee appraises the collateral and determines the amount that the client can loan. The collateral and the loan sum are registered in the pawn system.

The municipality of Amsterdam asked INFO to rebuild and optimize the pawn system that the Stadsbank van Lening had been using for over fifteen years. The main goal? To create more efficiency so that customers can be served faster.

Additionally, from a social standpoint, it’s paramount that customers are able to repay their debts as fast as possible. To encourage this, they also asked us to improve the existing online customer environment.

The solution

We mapped out the Stadsbank’s current processes by shadowing employees and by participating in workshops together with employees and other stakeholders. Because many of the Stadsbank’s employees have been with the bank for years, it was very valuable to observe them to find out the old system’s bottle necks.

During co-creation sessions, we came up with the first concepts for the new loan system, which we then validated with the bank’s employees. The goal of the new loan system is to simplify to the process for the employee, so that they can help customers faster.

A new loan system

In order to make sure that we created the right digital product for both the employees and the customers of the Stadsbank van Lening, we worked closely together with the Product Owner and other experts from the Stadsbank during several Scrum sessions.

We were able to improve the most important desk processes. When pulling up customer data, the employee will now have direct access to the customer’s most important data, such as outstanding loans, deadlines and other relevant information. This enables the employee to take immediate action, if needed. We’ve also merged a couple of processes, such as adding new collateral and extending or collecting a pawn, into a single flow, eliminating unnecessary actions. In addition, we’ve integrated all supporting processes, such as management and financial checks.

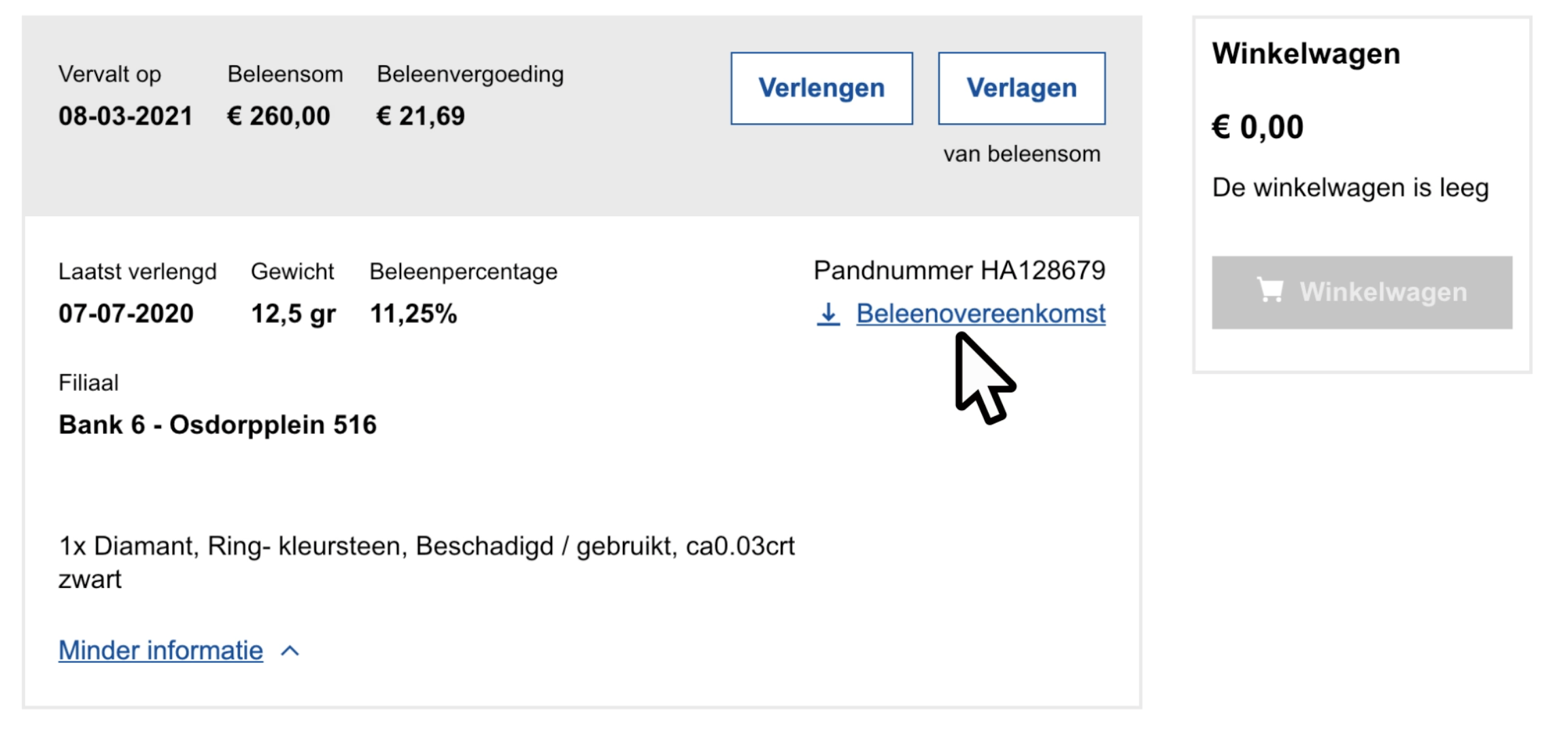

Besides the new pawn system, we’ve also realized a new online client portal. In the My Stadsbank van Lening environment, customers can view and extend their pawn(s) themselves, as well as lower their loan. Because they are now able to lower their loans themselves, customers are encouraged to pay off their debts faster. Also, this way, they don’t have to come down to the office, which, especially during the pandemic, removes a significant barrier.

Both systems were developed using the newest technologies, which greatly increased productivity during the developmental stages. Thanks to the use of Kotlin we could build the software faster, without compromising on quality and GraphQL made the communication between the frontend and backend developers (much) easier.